Welcome to 'Mortgage Mentor' iPhone and iPad app. Follow the links below to find out more:

My Mortgages Calculators

Calculators Settings

Settings Disclaimer

Disclaimer

My Mortgages

TopIn this section you can enter details of loans, view a summary or a monthly breakdown of a loan, and compare several loans graphically.

Entering Loans Overpayments

Overpayments Additional Costs

Additional Costs Loan Summary

Loan Summary Loan Breakdown

Loan Breakdown Email Loan Details

Email Loan Details Comparing Loans

Comparing Loans

Entering Loans

TopTo get started, you need to enter some loans. Click on the '+' icon at the top right of the screen to add a new one. You must enter certain key facts about the loan.

Name

This name helps you to identify the loan. It must be entered, but it can contain whatever text you like.Loan Amount

This is the amount of money you need to borrow.Rate (%)

This is the annual rate of interest on the loan, e.g. 3.99. If you enter an 'Initial Rate', then this becomes the subsequent rate.Term

This is the length of the loan expressed in years and months.Mortgage Type

Choose either a 'Repayment' or 'Interest Only' mortgage. A 'Repayment' mortgage means you pay back interest and part of the capital each month. An 'Interest Only' mortgage means you only pay back the interest owed each month.Initial Rate (%)

Some loans have an introductory period with a lower rate. Optionally enter the introductory rate here.Initial Term

This is the length of the introductory period in years and months.Start Date

Optionally enter a date which will represent the month of the first payment. If you enter this, then the analysis charts/tables will show a date, rather that a year and month number.Overpayments

See OverpaymentsFees & Costs

See Additional CostsOnce you have entered all the key facts then press 'Done' to save your changes.

Overpayments

TopHere you can optionally add any number of extra payments, either 'Monthly', 'Yearly' or 'One Off'. Click on the '+' icon at the top right of the screen to add a new one. To delete one, swipe across it.

You also have the choice of whether extra payments 'Reduce Term' or 'Reduce Payments'. If you 'Reduce Term' then subsequent mortgage payments stay the same and the length of the loan is shortened. If you 'Reduce Payments' then subsequent mortgage payments are reduced and the length of the loan stays the same.

Type

Choose whether the overpayment amount is once a month, once a year, or a one off payment.Amount

This is the amount you wish to overpay.Start

When you want the overpayment to start taking affect. It defaults to the first month of the loan.End

When you want the overpayment to stop. It defaults to the last month of the loan.Additional Costs

TopHere you can add any additional mortgage costs. These costs will be added to the monthly payments and will give you a better idea of the 'True Cost' of your mortgage.

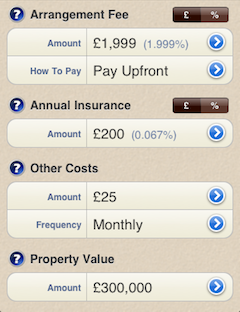

Arrangement Fee

A lender may charge a fee for arranging the mortgage. You can enter either an 'Amount' or a 'Percentage'. Tap on the currency symbol or the percentage sign to choose which. If you choose 'Percentage', then the amount will be calculated as a percentage of the 'Loan Amount'. You can also choose whether to pay the fee upfront (gets added to the first monthly payment), or add the amount to the loan.Annual Insurance

Insurance, such as Buildings Insurance or Hazard Insurance, is often compulsory, and may be entered as a fixed yearly amount or as a percentage of the 'Property Value'. The calculated yearly amount will be divided by 12 and added to the monthly payment.Other Costs

There may be other costs you wish to include such as Property Maintenace Fees or Moving Costs. Enter the amount and whether it is a 'Monthly', 'Yearly' or 'One Off' cost. A 'One Off' cost will get added to the first monthly payment. A 'Yearly' amount will be divided by 12 and added to the monthly payment.Property Value

Property Value will need to be entered if, for example, you wish to specify 'Annual Insurance' as a percentage of the Property Value.Loan Summary

TopSelect a loan from the 'My Mortgages' screen. This presents the screen which lists the key facts about the loan. Then tap the pie chart icon

located on the top right of the screen to bring up the summary view. The following information is displayed:

Monthly

This is the monthly payment, including any regular monthly overpayments and additional costs. If an initial rate has been set, then this is the monthly payment for the initial term.Monthly (thereafter)

This only appears if an initial rate has been set. It is the monthly payment after the initial term expires.Overpayments

This is the total amount overpaid across the lifetime of the loan. If will only appear if you have entered one or more overpayments.Total Years

This is how long it will take to pay off the loan, taking into account any overpayments.Paid (first x years)

This only appears if an initial rate has been set. This is the total amount paid in the initial term.Total Paid

This is the total amount paid across the lifetime of the loan.Pie Chart

This shows the ratio of interest paid, capital paid and additonal costs, across the lifetime of the loan. It is only shown for 'Repayment' mortgages.Investment examples

For an 'Interest Only' mortgage, if you intend to pay off the remaining capital by the end of the term, then you need to make a separate investment. To give you an idea of how to achieve this, examples are shown of how much you would need to invest each month at different interest rates.Loan Breakdown

TopSelect a loan from the 'My Mortgages' screen. This presents the screen which lists the key facts about the loan. If you rotate the device so that it is on its side, you will be presented with an interactive graphical view of the loan.

The chart shows the years on the x-axis verses the amount on the y-axis. If you have entered an 'Initial Rate', this will be indicated by a dashed grey line at the end of the 'Initial Term'.

Pinch to Zoom

Pinch along the years axis to decrease or increase the year range. Double tap to reset.Press and Hold

Press and hold on the chart to show values for a year. Slide your finger along to show values for other years.The four buttons at the bottom of the screen allow you to switch between:

Balance

The balance of the loan which you will see decrease steadily over time.Total Paid

The total amount paid which will increase steadily over time.Total Interest

The total interest paid which will increase over time, but at a gradually slower rate.All

All three of the above overlaid on top of each other.The cog icon

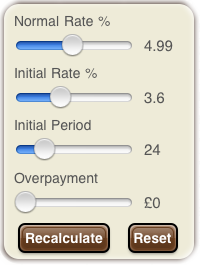

allows you to try out various 'What-If' scenarios

You can change the 'Normal Rate %', 'Initial Rate %', 'Initial Term' or add an 'Extra Monthly Amount'. The chart is automatically refreshed to show the effects of your change. The adjustment is only temporary and does not change the key facts of your saved loan. Press 'Reset' to revert to the original values.

The table icon

switches you to a new screen with a table showing you the 'Monthly' breakdown of the loan. If you would like to see a 'Yearly' breakdown instead, then double tap the table. Double tap again to switch back to 'Monthly'.

Year

This is the current year number.Month

This is the current month of the year.Payment

This is the standard monthly/yearly mortgage payment, not including any overpayment or additional costs.Overpay

This is the overpayment amount for the month/year, if entered.Interest

This is the interest paid off in the month/year.Total Paid

This is a running total of the total amount paid so far.Balance

This shows the amount of capital still to pay off.On the right hand side of the screen there is a set of controls. You can use the arrows to page up and down a year at a time, or jump to the start or end of the table.

The cog icon works in the same way as it does on the chart screen. The chart icon

returns you to the chart screen.

To exit either the chart of the monthly breakdown screen, simply rotate the device back to the upright position.

Emailing Loan

TopThe mail icon

appears on the loan details screen. This allows you to email the loan details so you can access them on a PC or other device. Tapping on the icon presents you with the option of generating the loan details as a PDF document or formatted as HTML. The loan chart is also attached to the email.

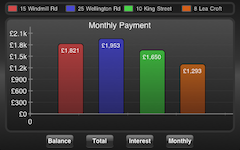

Comparing Loans

TopOnce you have entered two or more loans in the 'My Mortgages' screen, a 'Compare' button will appear. When you press on this the table changes to allow you to select multiple loans for comparison. You can now select up to four loans. Once you have selected your loans, then rotate the device so that it is on its side. You will then be presented with an interactive chart to compare the loans.

Pinch to Zoom

Pinch along the years axis to decrease or increase the year range. Double tap to reset (not relevant to Monthly Payments).Press and Hold

Press and hold on the chart to show values for a year. Slide your finger along to show values for other years (not relevant to Monthly Payments).The four buttons at the bottom of the screen allow you to switch between:

Balance

The balances of the loans.Total Paid

The total amount paid for each loan.Total Interest

The total interest paid for each loan.Monthly Payments

The monthly payment for each loan, including any regular monthly overpayments and additional costs. If an initial rate has been entered, then the monthly payment is based on the this rather than the subsequent rate.To exit the compare screen, simply rotate the device back to the upright position.

Calculators

TopThe calculators are simple and quick, and give you an instant idea of how much you can borrow, how much a loan will cost you, and even how you can reduce the total cost and length of a loan by overpaying.

Touch the links below to find out more:

What Can I Afford? Cost Of Moving

Cost Of Moving Monthly Payments

Monthly Payments Overpayments

Overpayments Remortgage

Remortgage Stamp Duty

Stamp Duty

What Can I Afford?

TopThis calculator gives you an idea of how much money a lender will lend you. It calculates the minimum and maximum values you could typically borrow (1). Normally the amount you can borrow will be somewhere between the Minimum and Maximum.

(1) Some banks may lend you more or less depending on your personal circumstances.

Single/Joint

Choose 'Single' if you are buying the house on your own, or 'Joint' if you are buying with a partner.Annual Salary

The borrower's annual salary (including bonuses), before any tax is deductedMinimum

The minimum amount a lender may lend youMaximum

The maximum amount a lender may lend youCost Of Moving

TopThis calculator is a handy checklist of the various costs you incur when moving house. This can often add up to be more than you expected. Fill in the costs and it will tell you how much money you need to set aside to cover the cost of the move.

Stamp Duty (or Property Tax)

Enter the tax you will pay on the value of the property.Solicitor's Fee

Most people will use a solicitor to handle the legal side of moving house. Enter this cost here.Agent's Fee

If you are selling a house, an estate agent (or real estate agent) may charge a percentage of the property value, or a fixed fee. Enter this cost here.Removal's Fee

A removal company is often necessary, enter this cost here.Survey Fee

A lender often insists you pay for a 'Valuation' survey. It is also common to pay for a more in depth survey to establish any potential problems. Enter this cost here.Mortgage Fee

A lender may charge a fee for arranging the mortgage, either a percentage of the property value, or a fixed fee. Sometimes this gets added to the loan, but other times it must be payed up front. If it must be payed up front then enter this cost here.Other costs

Enter any other costs here. For example, you may have to purchase furniture or pay for some work on the new house.Total cost

This is the total amount you need to set aside to cover the cost of the move.Monthly Payments

Top This calculator will tell you how much a particular mortgage will cost you per month.Loan Amount

This is the amount of money you need to borrow.Rate (%)

This is the rate of interest on the loan. e.g. 3.99Term In Years

This is the length of the loan expressed in years. e.g. 25Mortgage Type

Choose either a 'Repayment' or 'Interest Only' mortgage. A 'Repayment' mortgage means you pay back interest and part of the capital each month. An 'Interest Only' mortgage means you only pay back the interest owed each month.Monthly

This is the calculated payment per month.Total Paid

This is the total amount the loan will cost you over its lifetime.Overpayments

Top This calculator will let you know the benefits of overpaying each month. Overpaying means that you pay an extra amount on top of the standard monthly payment. By overpaying you will save on the total amount paid, as well as paying off the loan more quickly. Note that it assumes this is a 'Repayment' mortgage.Loan Amount

This is the amount of money you need to borrow.Rate (%)

This is the rate of interest on the loan. e.g. 3.99Term In Years

This is the length of the loan expressed in years. e.g. 25Overpayment

This is the extra amount you will pay each month.Monthly

This is the calculated payment per month, including the overpayment.Total Paid

This is the total amount the loan will cost you over its lifetime.Total Saved

This is the total amount you save over the lifetime of the loan by overpaying.Years Saved

By overpaying you reduce the length of the loan. This tells you how many years you save.Remortgage

Top This calculator will give you an idea of how much you could save (or not) by refinancing your loan. It tells you the monthly and total savings, plus the savings after years 1, 2, 3 and 5.Current Loan Amount

This is the remaining balance on your current loan.Current Rate (%)

This is the rate of interest on your current loan. e.g. 3.99Current Term In Years

This is the remaining years left on your current loan. e.g. 12.5Exit Fees

These are the fees (if any) you must pay for paying off the loan early. e.g. a redemption fee or early repayment penalty.New Loan Amount

This is the new amount of money you plan to borrow.New Rate (%)

This is the rate of interest on your new loan. e.g. 3.99New Term In Years

This is the length of the new loan expressed in years. e.g. 15Arrangement Fees

These are the fees (if any) you must pay to get the new loan. e.g. loan application fee, lawyer's fees.Stamp Duty (UK Only)

Top This calculator will tell you how much tax you have to pay when you buy a house.Property Value

The value of the property you wish to buyFirst Home

Choose 'Yes' if you have never purchased a house beforeStamp Duty

This is the amount of tax you will have to pay when you buy the houseSettings

TopHere you can configure certain behaviour in the app:

Down Payment

If you turn this on, then when entering the Loan Amount, you are taken to a screen which allows you to additionally enter the Property Value and the Down Payment. This gives you the option of having the Loan Amount calculated for you. You may still enter the Loan Amount manually if you prefer.Pay Frequency

If you turn this on, then a new entry appears in the Loan Details screen called 'Pay Frequency'. This allows you to specify payment periods which are not Monthly. e.g. Weekly, Bi-Weekly.Decimals in Breakdown

If you turn this on, then the amortization table shows decimal values, rather than rounded whole numbers. This gives greater accuracy as it will show cents, pence and so on. This applies to the email amortization table as well as the standard amortization table.Credits

Top Tab Bar Icons Calculator Icon Charts Ray Wenderlich Cocoa With LoveDisclaimer

TopThe data presented by this app serves as a guide only. Each loan is different and each may have special clauses which affect the calculations. Similarly, each country or state may have their own laws and taxes which affect the calculations. All reference to interest rates refer to the annual interest charged on the capital of the loan, not the APR. All calculations assume interest is compounded on a monthly basis. We recommend you seek help from a financial advisor before agreeing to the terms of a loan.